Underinsurance is a persistent problem that leaves property owners vulnerable to significant losses, so risk management firm Intelligent AI has partnered with the Building Cost Information Service (BCIS) to provide a service that produces reinstatement cost assessments at the touch of a button.

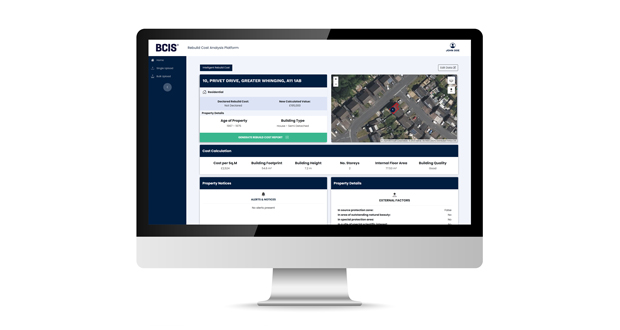

The BCIS Intelligent Rebuild Cost Platform draws from multiple data sources to create rebuild cost reports for residential and commercial properties, including BCIS reinstatement data, planning applications and satellite imagery.

Crucially the platform can report on everything from individual residential properties to multi-billion-pound commercial portfolios, enabling annual assessments.

James Fiske, BCIS CEO, said: “We help property professionals to not only access high-quality data, but to understand the most appropriate data for what they need. Sadly it’s not uncommon to find unreliable sources of data being used to inform business decisions.

“The use of problematic data is of course not limited to reinstatement values, but the financial risk in this area could be the most significant one a property owner or portfolio manager has, if they are exposed to considerable loss through underinsurance. On the flip side, having a clearer view of the rebuild costs also helps to avoid overinsurance, and overpaying on a policy.”

Using reliable, verified data is crucial to reducing instances of underinsurance and is the driving principle at the heart of the platform.

BCIS reinstatement cost data alone constitutes more than 1,100 dwelling models and 650 ancillary models, representing a wide range of supporting structures, components, and features. These models are built upon input costs derived from upwards of 12,500 regularly updated supply prices, as well as labour, plant, and specialist rates, in total producing more than four million rebuilding cost permutations.

Intelligent AI CEO, Anthony Peake said the platform, which has been developed using ground-breaking AI tools, together with support from Lloyd’s Lab and leading insurers, is a great example of how technology can free up professionals to better service their customers.

He said: “A desktop assessment carried out to industry standards could take over an hour to complete. The BCIS Intelligent Rebuild Cost Platform can perform the same task, just as accurately and for less cost, in 10 seconds.

“This isn’t about replacing a human’s role in reinstatement assessments. It’s about automating the bulk of cases which are straightforward, while at the same time highlighting the cases where a surveyor still needs to go in and make their professional judgement.

“For a property portfolio owner or manager, the platform enables them to do an initial risk assessment of all their properties, to do an assessment at the point of renewal, and to keep track of what costs are doing in between.”

The FM industry is evolving quicker than ever before, and so are the demands of the customers it serves.

To help shed light on some of the trends that are shaping the sector, Biological Preparations, a leading UK biotech company, is conducting a survey in collaboration with FMJ to identify the sustainability priorities and challenges amongst FM leaders.

This five-minute, anonymous FM-focused survey, offers FM professionals of all hierarchies with a platform to voice their perspectives and share their experiences.

As a thank you for taking part in the survey you will be entered into a prize draw to win £250 worth of Amazon vouchers.

To share your experiences, please click here.