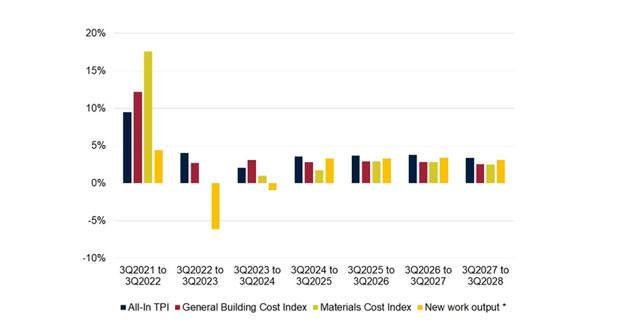

Latest projections from the Building Cost Information Service (BCIS) forecast construction costs to rise just over 3% in the year to 3Q 2024, while tender prices are expected to increase by just over 2% in the same period.

In its five-year forecast published for 3Q 2023, BCIS outlines its expectations for the industry, set against a backdrop of tightening market conditions.

From 3Q 2024, the BCIS says costs are set to rise between 2% and 3% per annum until 2028. This is slightly less than tender prices, which are expected to increase between 3% and 4% per annum in the same the period.

With growth in the UK economy expected to be subdued for the next two years, BCIS is predicting construction output to fall this year and next, mainly because of decreases in housing and private commercial work, but to recover slowly from 2025.

* BCIS forecast of new work output at constant 2019 prices

Source: BCIS, ONS

Reflected strongly in the market conditions element of TPI is labour supply and costs. Construction site rates, in line with inflation, continue to rise faster than wage awards, becoming the main driver of the growth in overall costs. The BCIS General Building Cost Index (GBCI) is forecast to grow by 2.7% in the 12 months to 3Q 2023.

Materials cost inflation, on the other hand, continues to cool from the peaks seen in 2Q 2022 and there remains good availability for most construction products.

The BCIS Materials Cost Index is expected to remain at the same level in 3Q 2023, compared to 3Q 2022, and increase by 1.0% in the 12-month period to 3Q2024.

New work output is expected to contract in 2023-2024, before returning to growth thereafter, and rising 6% over the forecast period to 2028.

Recent changes to planning policies are reportedly adding pressure to and causing delays in the project pipeline.

Chief Economist for BCIS, Dr David Crosthwaite said: “Against an economic backdrop where we can see the effects of monetary tightening feeding through, we expect the construction industry, as well as the wider economy, to remain resilient.

“However, there is real concern over the industry’s ability to supply sufficient skilled labour in the near and medium-term future. The effects of a shortfall have perhaps recently been tempered by a reduction in demand.

“As output increases, labour shortages could be exacerbated by issues like the RAAC crisis, with remedial work needed where the use of reinforced autoclaved aerated concrete in schools and hospitals, as well as other public buildings, has been identified. And, although materials cost inflation has been easing, prices remain elevated compared to pre-Covid levels.

“A significant unknown is the outcome of the next general election and what, whichever government emerges from that, its plans will be to deal with the crucial areas of housing, health, education and infrastructure provision.

“Government commitment to net zero targets and environmental policies, and the degree to which it commits to long-term strategies and investment, will also have a far-reaching effect at every level.

“In the more immediate future, we’re seeing the impact from construction insolvencies on disrupted supply chains and reduced capacity, impacting on contractors’ appetite for risk and on tender prices.”