STRATEGIC ROLE

As the Idox ‘Future of CAFM’ research confirms, there is a growing recognition that facilities management is an increasingly strategic business function, with a far-reaching influence across diverse operational activities. While 77 per cent say facilities management improves the energy efficiency of buildings, 76 per cent also confirm it helps to control compliance risks and 62 per cent say it supports business continuity planning, ensuring businesses can continue to operate effectively in the event of interruption due to power outage or building damage. Over half (55 per cent) say facilities management supports social value strategies, including CSR and ESG.

In addition, facilities management’s direct impact on the experience and performance of employees is widely recognised, with over two thirds (69 per cent) confirming it helps to increase employee satisfaction and wellbeing and 55 per cent saying it helps the productivity of workers.

There is no doubt that FMs have significant and growing opportunities to deliver tangible corporate value. Energy efficiency can be transformed through proactive management of buildings’ energy consumption and effective space utilisation. Optimised work order processes can minimise engineer drive time, improving staff efficiency while also delivering the Planned Preventative Maintenance (PPM) model that maximises the performance and lifetime value of equipment.

The established shift to remote and hybrid working provides businesses with the chance to close offices, with the associated benefit of cutting costs and further boosting sustainability credentials. However, with many businesses also fearing the productivity and, critically, mental wellbeing of remote working employees, FMs are also being tasked with improving the quality of the working environment.

Yet the majority of FMs still lack the insight required to achieve these strategic imperatives. What are the cost and emissions implications of closing offices? What additional facilities are required within a building to ensure employees make the most of in-office days? Can assets be relocated to maximise utilisation? As this research confirms, not only are 70 per cent of facilities managers still using spreadsheets, but just 41 per cent have the CAFM systems in place required to deliver accurate and immediate cross-operational information. So how are FMs planning to deliver this broad strategic remit?

BUDGET AND WORKFORCE SHORTAGES ARE THE BIGGEST CONCERNS

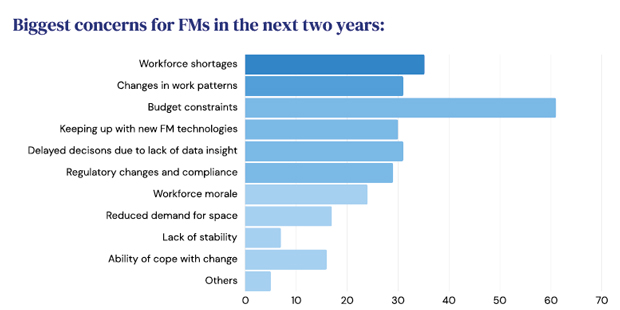

Indeed, when budget constraints (61 per cent) are the biggest concern facing FMs over the next two years, followed by workforce shortages (35 per cent), many will struggle to find time to focus on strategic goals without better systems to drive efficiency and improve operational reporting.

Pressure on budgets is heightened by the well documented loss of facilities management staff, with the inevitable disruption, time and cost associated with recruitment. It remains difficult to attract people into the industry, especially the younger generation. Creating the right environment for FM teams is key to boosting morale and, therefore, improving retention – with 24 per cent also citing workforce morale an important problem to address over the next two years.

FMs are also concerned about delayed decision making due to lack of data insight (31 per cent), changing work patterns due to hybrid working (31 per cent), the challenge of keeping up with new FM technologies (30 per cent) and regulatory change and compliance (29 per cent). The lack of data insight is an understandable concern given strategic expectations facing FMs outlined above.

Without robust CAFM solutions, organisations not only lack trusted information to support decision making but will also be unable to explore innovations in technology, such as the Internet of Things (IoT), that will be key to improving the energy efficiency of buildings and meeting compliance objectives.